Bitcoin, the granddaddy of modern public permissionless blockchain networks, was launched in 2009. It was designed for mostly financial applications. We now call it a “generation 1” blockchain, because there were more generations coming. Today we will consider the contributions of a couple of its descendents.

Ethereum: Trailblazing in Blockchain Innovation

Ethereum was launched in 2015, and it brought transformative new ideas to blockchain. Ethereum’s innovation lies in its ability to host decentralized applications (dApps), making it a cornerstone for DeFi projects. Another most notable contribution is the introduction of the ERC-20 standard.

Smart Contracts

Ethereum introduced “smart contracts” to the blockchain. These self-executing contracts have the terms of the agreement directly written into computer code. This innovation expanded blockchain’s utility beyond mere financial transactions. Due primarily to this key innovation, Ethereum is thought of as a generation 2 blockchain.

ERC-20 standard

ERC-20 is a technical standard used for smart contracts on the Ethereum blockchain for implementing tokens. It defines a common list of rules and functions that an Ethereum token has to implement, giving developers the ability to program how new tokens will function within the Ethereum ecosystem. The ERC-20 standard made it possible to create stablecoins and governance tokens, for example.

You still have to write niche, advance computer code in order to:

- manage the supply and demand of your token,

- keep track of users’ balances mediate all transactions on the * Ethereum network that include your token.

Launching your own ERC-20 token can be expensive if you have to hire software engineers skilled in writing Ethereum smart contracts. However it is still far cheaper than creating your own blockchain.

Cardano: Advancing Blockchain with a Research-Driven Approach

Cardano is considered a 3rd generation blockchain. The network is distinguished by its strong emphasis on a research-led methodology and peer-reviewed development. Launched in 2017 by one of Ethereum’s co-founders, Charles Hoskinson, Cardano aims to offer a safer, self-sustaining and flexible ecosystem.

Cardano’s most significant contributions to the industry are

- its layered architecture and Bitcoin’s UTXO styled accounting,

- a novel self-sovereign mechanism to pool resources and security

- a fundamental rethinking of tokens on the network and departure from the ERC-20 standard.

eUTXO powered Layered Architecture

Like Bitcoin, accounting on Cardano is not centrally stored in some global state but instead is locked in disparate locations around the network. Only the group or individual with the key to each location has control over the movement of things locked in each location. Cardano uses one layer for enforcing account rules (the Settlement layer) and a separate layer for running smart contracts (the Computational layer). Using eUTXO accounting makes it harder for bad actors to steal user funds since the default location of funds are scattered around individual user pots, rather than a central pot. The separate layer means user application, games, and other dApps running on the computational layer of the system won’t interfere with more critical financial transactions. Having separate layers also means each layer can be optimized exactly for their respective use cases rather than a generic, inefficient, one-size-fits-all single layer.

Pooling resources and security

Cardano is a delegated “Proof-of-Stake“ network. This means that the job of securing and running the network is divided into discrete, interdependent roles. When pooled, these roles create a robust and secure system. This mechanism also makes Cardano thousands of times more energy efficient than its famously power-hungry forebears.

(Notably, Ethereum has recently made a move from its previous “Proof-of-Work” consensus mechanism, and is now using Proof-of-Stake as well. However, the details are still very different.)

Native Asset Standard

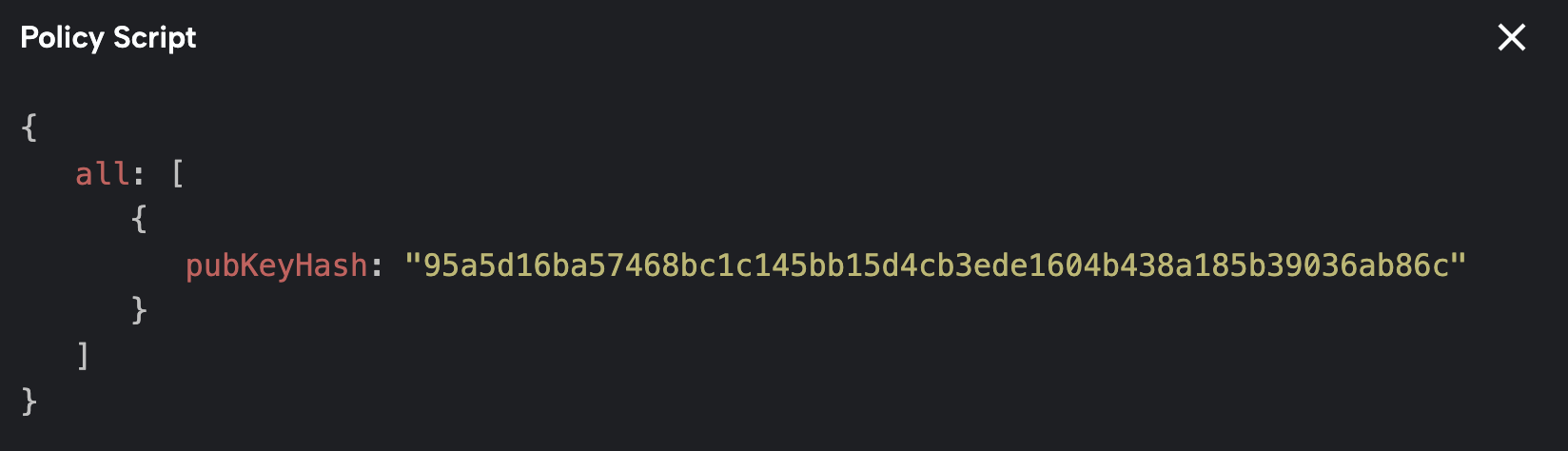

Rather than having tokens rules that are mediated by smart contracts and having to manage your own accounting as with the ERC-20 standard, the Cardano network has the concept of native assets. With the native asset standard you tell Cardano the rules around when more of your token can be created or destroyed and Cardano directly handles the rest. Accounting is handled by the network in the same way accounting for Cardano’s native currency Ada is handled. Hence, your token becomes a ‘native,’ first class citizen on the network. For our very own Phuffycoin token, here’s the instructions we had to give cardano, simply saying “everytime new Phuffycoin is created, or destroyed, the owner of public key 95a5d16ba57468bc1c145bb15d4cb3ede1604b438a185b39036ab86c has to include their digital signature in the transaction:

One big benefit of Native assets on Cardano over ERC-20 tokens is the cost. It’s much easier and simpler to create native assets on Cardano, reducing your engineering costs. Also, because you don’t have to run a smart contract every time your token shows up in a transaction, transaction fees involving your token are also often 10 to 100x cheaper than their ERC-20 counterparts.

Another advantage of the Native Asset Standard is that it is predeterministic. This means that before the user enters their password to approve the transaction they will see the exact cost and fees. This is only possible because Native assets are native, already known, to the network. This is not possible with ERC-20 tokens because of the unknown arbitrary computer code that has to run when you interact with those tokens–the system has no way of predetermined the resource it will take to execute the code.

Challenges and Future Outlook

Both Ethereum and Cardano have their respective challenges. Ethereum’s transition to Ethereum 2.0 is a complex process with significant technical and community coordination challenges. Some have likened it to replacing a jet engine while the plane is in flight.

For Cardano, while its scientific approach is commendable, it has led to a slower development and deployment pace, with business and developer tooling still lagging behind the alternatives. This is compounded by the fact that Cardano’s novel approach to most things means that businesses have to first grapple with new paradigms before becoming productive and creative.

Looking ahead, both platforms are poised to play crucial roles in the blockchain industry’s future. Ethereum’s move to Ethereum 2.0 could solidify its position as a leader. Meanwhile Cardano’s innovative solutions and growing ecosystem show great potential for widespread adoption. The future is not a question of either-or, or who will win. Every innovative technology with an engaged and creative community has something to offer.

Conclusion

As the blockchain landscape continues to evolve, these two platforms will undoubtedly be at the forefront, driving the industry toward a more efficient, secure, and decentralized future. Whether through Ethereum’s pioneering smart contracts or Cardano’s methodical, research-first approach, their contributions are shaping the blockchain revolution, heralding an exciting era of technological advancement and digital transformation.

No comments yet…