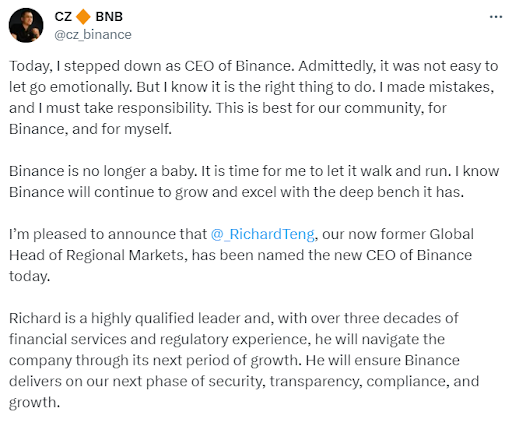

Hi everyone, this is Charles Hoskinson. I wanted to talk about the Binance situation briefly. Many of you know that my friend CZ stepped down [as CEO of Binance].

CZ was part of a class of entrepreneurs in the cryptocurrency space who really epitomized the “Move fast, grow, and innovate” side of things. He ran a business that was regulated or quasi-regulated - depending upon the jurisdiction - and during the early days of crypto, nobody cared.

I’m old enough to remember the days of crypto when people would actually go to Mt. Gox and transfer money to it using PayPal or other services like that; that would be how you bought Bitcoin! Or there was LocalBitcoins where you’d find [local] people, and they’d show up, and you just give them some cash and they’d send you some Bitcoin. I remember people trading Bitcoin on spreadsheets over BitcoinTalk and other websites. There was Roger Ver [former CEO of Bitcoin.com] and all the stuff that he did. There was [ShapeShift founder] Eric Vorhees, [Bitcoin developers] Mike Hearn and Gavin Andresen, back in the day… It was a very small club. Peter Vinnik was another one; he tried to go and create the Bitcoin Foundation. That never worked as well as one would have hoped. And we had our villains back then, like [Former CEO of Mt. Gox] Mark Karpeles, and others.

CZ came in with a second wave, and Binance was started around 2017, and they became a Leviathan in our industry. They were newer in the pack, the second wave of exchanges after the failure of Mt. Gox. He was one of the greatest entrepreneurs of our time in the industry. Trillions of dollars of assets flowed through Binance, and for a new exchange, that’s pretty much unheard of. Given that all those assets were completely invented by this industry, the fact that they had that kind of valuation is extraordinary as well.

What’s happening right now is a fundamental change in the industry, where there’s a movement towards regulated business. The legacy world is merging with the crypto world. This is difficult because the legacy world is radically incompatible with the crypto world.

The United States has a financial regime that basically has been weaponized. There are great books like Juan Zarate’s “Treasury’s War” and others that describe the global sanctions regime, AML [Anti Money Laundering], KYC [Know Your Customer], and anti-terrorist financing. This is just the way the legacy world works, and every single bank and financial institution is subservient to it and the regulatory panopticon* that’s been constructed. The world is also becoming very multipolar, and there are a lot of countries now that are NOT following that regime anymore. Crypto is caught in the middle of all of this. For entrepreneurs in our space, from the era of “well, we don’t care, we’re not going to pay attention to it,” - they kind of got swept under the rug.

Binance will continue on. It’s now going to be under leadership that will work with the US government as a partner. This means every substantive business decision that they make from this point on, from token listing to new product development, will be in consultation directly or indirectly with the US Treasury Department.

The good news is that we, as innovators, still have a lot of power. There’s a lot of really cool, interesting academic projects:

- Midnight is this idea that you can have algorithmically generated law and regulated value transfer protocols, and put it together with zero-knowledge proofs.

- Stanford has a group called Codex, working on something called “computational law” - basically, you bring engineers and lawyers and entrepreneurs, and you try to algorithmically define law.

- In the Ethereum space, there’s a project called Open Law, where they take real-world contracts, and they try to add a legal DSL [Domain Specific Language] to them. So, you combine a smart contract with a legal DSL. (But you need a privacy component for this to actually work, which is why Midnight exists, and I do believe we can make it quite interoperable with these things!)

So, the fourth generation cryptocurrency is no longer about scale and governance. That’s the third generation - that’s where we’re at [now]. The fourth generation is about the merger of the legacy world [with the decentralized world].

But the era of the crypto industry I grew up in is over. Binance was one of the last holdouts [but] there’s going to be more to come. I suspect that the US government is going to start hitting more providers of liquidity. Non-custodial wallets will likely get hit at some point, for a variety of reasons, especially if they integrate with the metaverse and these types of things. That [would be] an attempt to capture, from a regulatory viewpoint, all the core infrastructure of our industry.

There’s a ton of tools that they have to do this. You’ll notice in the press conference that they held with Merrick Garland and Janet Yellen, in addition to discussing financial crimes, they mentioned the words “national security” again and again. The reason they do that is that national security is tied to the financial markets. That’s the point of reading Juan’s book, “Treasury’s War.” It really shows you how the US government thinks about these things, and crypto’s gotten large enough and significant enough that it has to fit into the mindset of national security for the United States, European Union, and other great powers as they play a big chess game with the world. So we, in the industry, have to innovate. We, in the industry, have to invest and build better technology. And ultimately, I think we can square this circle one way or the other.

For my part, CZ is a friend of mine, he’s a good man…at some point, I think he’s going to come back and be a great entrepreneur again and do some amazing things. Space moves on, we all move on. We have to adapt and change and grow.

There’s always something to do and a new challenge to take.

I think we predicted this with Cardano. We understood the need to innovate with integrity and to comply with integrity. We’ve invested as an ecosystem in core technology like:

- Atala Prism, which allows self-sovereign identity - ie. “identity with integrity.”

- Midnight, which gives all those components for data confidentiality required for handling of PII and regulated contexts.

- Deep thought about how we can build dApps and DeFi in a way that can make people happy but still preserve the tenets of decentralization.

- We even thought carefully about how we measure decentralization, through the Edinburgh Decentralization Index.

- Decentralized governance - to make sure that there’s proper checks and balances and there’s not key people or institutions that can become captured and basically used as a leverage point to control the entire protocol one way or the other.

So, many more things to come, a lot of work to come, but it’s kind of a bittersweet week. Now we have to enter a new chapter of crypto, the age of the fourth generation, the great merger of the legacy and the DeFi world… a reconciliation. And like what Hegel used to say, you know, there’s a thesis and an antithesis, and we’re going to have a great synthesis as they merge together.**

There’s going to be some way that we [move] beyond this. It’s going to require a lot of conversations and a lot of hard work, a lot of education, and a lot of innovation. We as a community will do it. We always do. We always rise to the occasion. The dream never dies. We have the best people. I think overall, our best days are still ahead of us. It’s just that these are the difficult ones, because nothing is simple anymore, and it’s not just about growth. Now it’s about careful consideration.

Cheers, everybody, and we, of course, wish CZ well and Binance well and hope for the best for everybody.

*Panopticon: the concept is to allow all prisoners of an institution to be observed by a single security guard, without the inmates knowing whether or not they are being watched.

**Turns out Hegel didn’t say this, but it’s a common misattribution. Instead, the Thesis/Antithesis/Synthesis concept originated with Johann Fichte, who employed the triad as a formula for the explanation of change.

No comments yet…