Detailed Plan

<u>………………………………………………………………………………………………………………………..</u>

<u>Introduction</u>

The DTF protocol offers much-needed alternative investments. Investable DAO Traded Funds, or iDTFs, are passively managed vehicles curated by our enthusiastic community of finance professionals, seasoned investors, Cardano developers, and blockchain aficionados.

ETFs for the digital age - each iDTF provides exposure to curated baskets of quality digital assets. iDTFs are also fully backed and can be tailored to reflect market segments such as DeFi protocols, large-cap tokens, small-cap NFTs, and more.

Simply put, iDTFs make it straightforward for investors to act on their conviction and invest in the Cardano community and broader cryptocurrency space. They are an obvious choice for newcomers as well as experienced community members looking for clear-cut and broad market exposure.

For a more detailed overview, please find our white paper attached.

<u>Example of types of fund</u>

DTF funds are created by grouping together assets. This is analogous in form to an ETF. There are no hard rules for what assets the community may choose to basket, but most funds will pick a certain quality and use that as a condition for inclusion. For instance, we might create a fund with the top ten DEXs in the Cardano ecosystem. In this case, we might take (in no particular order):

SundaeSwap

Ergo Dex

Cardax

Minswap

Adax

Orion

YaySwap

Polyswap

Vy Finance

Daemon Exchange

We would represent all ten DEXs in a single, purchasable asset – an iDTF. An iDTF token will represent a user's pro-rata share of the underlying assets allocated to the fund. In the example above, users gain straightforward exposure to all ten Cardano DEXs.

<u>Why are funds like this so important?</u>

<u>Diversification</u>

Funds provide exposure to a wide variety of assets. This spreads out risk among a group of assets instead of putting all your eggs in one basket. As such, you are protected from one of your assets causing a significant decline in your portfolio.

<u>Lower costs</u>

iDTFs, like ETFs and Index funds, are passive investments. Naturally, holders do not need to actively manage all of the assets of a particular iDTF actively. On the other hand, consistently buying in and out of the different assets would incur notable costs from transaction fees, swap fees, etc.

<u>Strong long-term returns</u>

Traditionally, ETFs and Index funds produce greater overall returns than most individually managed assets. The crypto market is still immature, and ETF-like products are scarce. Yet, if we are using traditional markets as a guide, the average returns on funds are about 7% better.

<u>Automation</u>

Our attached white paper covers in-depth the architecture and functionality of our protocol.

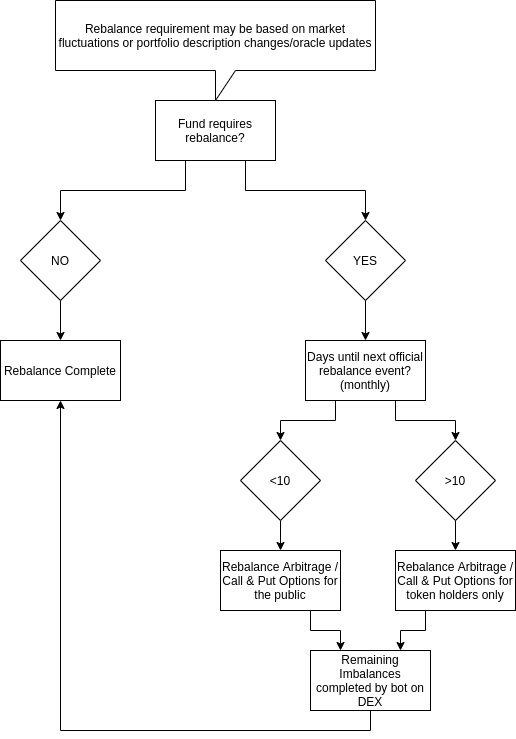

In general, the DTF protocol will be fully automated to the extent achievable. Pending product development, this will include the basic functionality of the vault structure, calculation of fees and discounts based upon the type of asset used to purchase the fund, enforcement of community decisions reached through our governance system, and most if not all of the functionality of the managing entity. The managing entity determines when rebalances take place and how they occur. Depending upon how the DTF community directs the protocol, some iDTFs could incorporate a methodologist entity that may be an individual or a group of individuals. Methodologists would handle more highly managed funds by calling vault functions under community oversight. They could also be given emergency responsibilities to maintain more volatile iDTFs during rapid market changes.

<u>Why should MLabs build this protocol?</u>

MLabs has quickly become one of the premier development firms in the Cardano Ecosystem.

We are an IOG Plutus Partner and are working with IOG to build seabug, which will be the first live NFT Marketplace using the PAB.

We employ over 65 developers helping to build community projects such as:

Liqwid

SundaeSwap

Ardana

CardStarter

PlayerMint

With many more projects in the early stages of development.

Because of our work on many of these early stage projects, we have one of the largest groups of Haskell / Plutus developers in the community. Developers working on DTF will bring their collective experience to the project and ensure a successful launch.

<u>Funding:</u>

Total: $70,400

<u>Breakdown:</u>

<u>Feature Total Time</u>

Multi-asset Vault Structure 80

Tracker 80

Re-balancing Functionality 120

Multi-Asset Dep Functionality 80

DTF Deposit Fee Logic 80

UI Display 40

General Testing 80

Audit Prep 80

Spec 80

Subtotal - 720

Change Budget 160

Total Time 880 hours

Total Cost $70,400

Number of Devs 2

Weeks to Launch 24

*Note: MLabs intends for this grant to be seed money to be used for our initial product development.

<u>Features / MVP:</u>

Our MVP will incorporate the following functionality:

Core functions:

-A multi-asset vault structure, codified in a smart contract, that mints iDTF tokens in a pro-rata manner upon receiving deposits. This is similar to how LP tokens are minted on other platforms.

-Configurable manager entity that tracks a fund's parameters as outlined in its prospectus

-Basic re-balancing functionality for vaults that incorporates a re-balancing phase, a grace period, and an unlocking phase where the vault can be traded against in order to re-balance

-Staking and voting

Deposit Options:

-multi-asset deposit functionality

-logic that defines DTF deposit fees relative to the asset allocation of a fund. For example, if a user pays an underweight asset, the DTF fee is lower. When paying in an overweight asset, the fee is higher.

-intuitive UI should display the status of fund and a user's position/share of it

iDTF tokens

-iDTF tokens are minted upon deposit and are also redeemable at any time.

<u>What success looks like:</u>

<u>By the first month:</u>

* Select a developer to head the project -

* Complete the full spec -

* Select a second developer -

* Start work on core functionalities -

<u>By the 3rd month:</u>

* Multi-Asset Vault Structure -

* Tracker

* Re-Balancing Functionality

<u>By the 5th month:</u>

* Multi-Asset Deposit Functionality

* DTF Deposit Fee Logic

* UI Display

<u>By the 8th month:</u>

* General Testing

* Audit Prep

* Audit

<u>Expected Launch:</u>

* 4th quarter 2022

<u>Conclusion:</u>

Mlabs has been busy contributing to the IOG code base and helping some of the premier projects in the Cardano ecosystem build their systems. This proposal is the first we, as a company, have submitted - We are excited to bring our experience to catalyst and look forward to hearing from the community.

Please comment and offer suggestions - we want to make MLabs DTF the best that it can be and we need your help in order to do that. We look forward to hearing from you!

Thank you!

MLabs

<u>How we see the key metrics of this fund and how it fits with our project:</u>

Key Metrics

<u>How many DeFi dapps were launched on Cardano mainnet within 3, 6 and 12 months after funding.</u>

* We have outlined a schedule that should get our MVP done within 8 months - keen observers will see that our overall estimate on total development time is less then 8 months. We think launch time less then 1 year but still greater then our estimated development will give us the proper cushion to deliver on time.

<u>How long does each dapp take to be launched.</u>

* Please see the above answer - We plan on delivering our MVP in 8 months.

<u>How many daily active users are the DeFi dapps funded in this cohort attracting.</u>

* We hope to have a user base similar to other defi apps of this type - Since there are currently no running defi apps on Cardano, we can't give a concrete answer yet.

<u>How much Total Value Locked (TVL) are the funded DeFi dapps able to capture 3, 6 and 12 months after launch.</u>

* This is also a difficult answer to give - We will have to see how the space develops when defi starts to go online in the next few months. We will have the ability to expand to handle whatever the load turns out to be.

<u>Number of bugs and vulnerabilities found in each dapp.</u>

* Our developers have been working on some of the premier projects in the Cardano ecosystem and we have also have included in our budget pre-audit checks and an official audit. This should mitigate the amount of bugs and vulnerabilities.

<u>Amount of resources lost due to bugs or vulnerabilities.</u>

* We hope to have 0 resources lost to bugs or vulnerabilities. We will submit our product to the new certification process at IOG, "This initiative has been led by Professor Simon Thompson, technical project director at IOG, and Shruti Appiah, head of product at IOG. It will help us comply with the best practices we've seen around the industry. We are working with Runtime Verification, Tweag, Well Typed, Certik, and others to roll out this new certification program that will link in with the new dAppStore, also unveiled in prototype form at the summit. This will be released in conjunction with the new light wallet."

<u>Number of users participating in testnets.</u>

* We will open MLabs to wide variety of users during our testnet period.

<u>Number of token holders/unique wallets(when dapp has a token).</u>

* TBD

<u>Distribution of supply between the team and the community.</u>

*TBD

<u>Numbers of listed pairs (in case of DEXs).</u>

* TBD from the community - We plan on starting with a few genesis funds but the growth of new funds depends on our community and the asset classes available on Cardano as the ecosystem grows.

<u>Number of listed assets (cases of loan+lending dapps, derivatives and synthetic assets).</u>

* TBD from the community - Please see the above answer.

<u>Number of articles and open source financial models research delivered to the community.</u>

* TBD - We will opensource all of the non-proprietary information to the community - We don't like to keep secrets.