[IMPACT] Please describe your proposed solution.

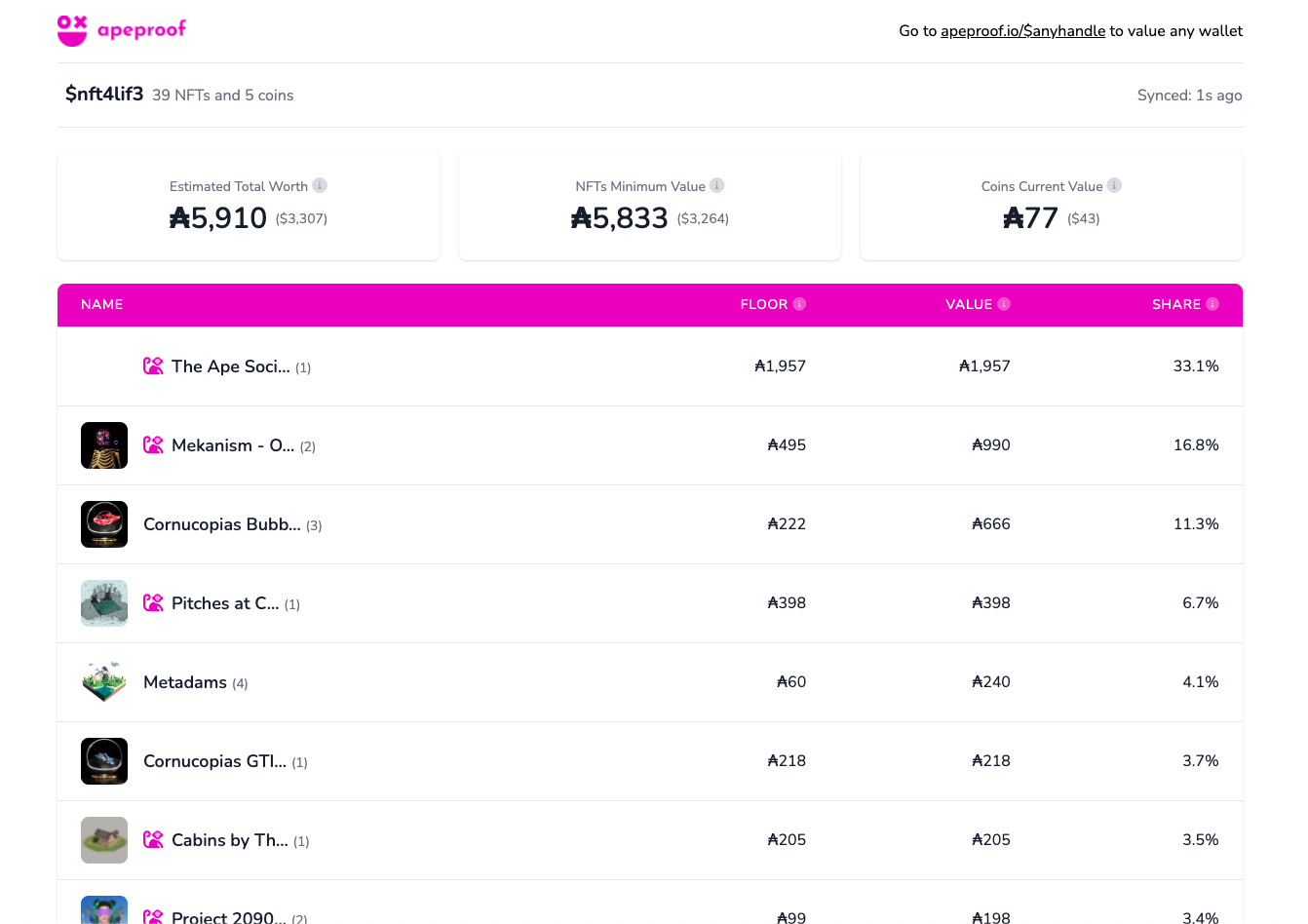

There are a few tools that help you value what’s in your wallet. However, they’re not complete yet and aren’t updating in real-time.

The first step is to calculate the value of a wallet. We need a tool that’s combining:

- NFTs

- Coins/tokens

- Assets directly owned or “inside your wallet”

- Assets indirectly owned, e.g. assets listed and offers made on a marketplace, and liquidity provided via a DEX

- Assets from all addresses from an account (stake key), e.g. to support Eternl

The second step is to calculate the profit of each transaction and wallet or number of wallets. To do this, we need to:

- Calculate mint prices of NFTs

- Calculate floor prices of NFTs (valuation methodology A)

- Calculate trait floor prices of NFTs (valuation methodology B)

- Calculate average sale prices of NFTs (valuation methodology C)

- Calculate exchange rates of coins/tokens

- Calculate transfers, deposits & withdrawals (from/to exchanges)

- Calculate ROI

- Sync all these rates & prices continuously

The third step is to be able to calculate the value of each wallet historically:

- Floor prices of NFTs

- Trait floor prices of NFTs

- Average prices of NFTs

- Exchange rates of coins/tokens

Steps 1, 2, and 3 will be done by directly querying the information on the blockchain as much as possible.

The fourth step is to translate this into fiat, also historically. For this, a sync with (an) external API(s) will be set up.

The fifth and final step is to export all this for a date or a period into a report that can be used for anyone to comply with tax regulations, e.g. for the IRS in the United States.

[IMPACT] Please describe how your proposed solution will address the Challenge that you have submitted it in.

This tool will help people be compliant with their country’s tax regulations while providing a great insight into their wallet’s value and profit/loss. It’s absolutely necessary for more adoption of the Cardano blockchain to have such a tool since once it will be available we will have jumped a big hurdle for people to come over to our blockchain. It will help adoption, but potentially also increase the activity of people already in the ecosystem, since they’ll be more confident to know how to report their profits (or losses) into their taxes.

[IMPACT] What are the main risks that could prevent you from delivering the project successfully and please explain how you will mitigate each risk?

The hard part is to support all types of transactions out-of-the-box and then combine all these data streams from minting services, marketplaces, DEXes, trading platforms, and more into a single number that needs to be as accurate as possible. Also, calculating the wallet’s value historically hasn’t been done before and is tricky due to the standards that only have been introduced recently (and are still in the making, since a lot is happening). After tests and experiments, we’re confident we can do this with our current team. In the end, the biggest risk for Cardano is not having a valuation and tax reporting tool like this at all.

[FEASIBILITY] Please provide a detailed plan, including timeline and key milestones for delivering your proposal.

Building the Valuation and Tax Reporting Tool requires these phases that could be delivered within 3-4 months, approximately:

-

Phase 1: Valuation - to be completed by June 2022 (almost finished)

-

Phase 2: Profit - to be completed by July 2022

-

Phase 3: History - to be completed by August 2022

-

Phase 4: Fiat - to be completed by September 2022

-

Phase 5: Reporting - to be completed by September 2022

[FEASIBILITY] Please provide a detailed budget breakdown.

The budget for this project is made up of 1,040 hours of development, totaling a budget of $62,400 at an hourly rate of $60/hour.

-

Phase 1: 200 hours ($12,000)

-

Phase 2: 400 hours ($24,000)

-

Phase 3: 320 hours ($18,000)

-

Phase 4: 40 hours ($1,200)

-

Phase 5: 80 hours ($4,800)

[FEASIBILITY] Please provide details of the people who will work on the project.

The team behind internet companies Ratecard and WebFeedback will work on this, led by founder and developer Jeroen Sakkers (alias: @victormundi):

-

<https://www.linkedin.com/in/jeroensakkers/>

-

<https://www.linkedin.com/company/webfeedback/people>

-

<https://www.linkedin.com/company/ratecardio/people>

[FEASIBILITY] If you are funded, will you return to Catalyst in a later round for further funding? Please explain why / why not.

No, that’s not what we have planned.

[AUDITABILITY] Please describe what you will measure to track your project's progress, and how will you measure these?

We’ll keep the community up-to-date through our Discord server (see: <https://discord.com/invite/rgArnAzGzd>), and will publish weekly updates on our progress. The community will also be able to vote on the implementation of features, the platform’s design and more.

[AUDITABILITY] What does success for this project look like?

After delivering this project it will be able to look up the value and profitability of any wallet on the Cardano blockchain. Also, you’ll be able to export a tax report for an address that you own, after you’ve authorized by connecting with your wallet. The project will help people to comply with tax regulations in their home country, which is currently a big/future risk for new people getting in as well as people making a lot of money//profit. We’re aiming for at least 10,000 exports of tax reports during the first fiscal year, and at least double that in the next.

[AUDITABILITY] Please provide information on whether this proposal is a continuation of a previously funded project in Catalyst or an entirely new one.

No.