[IMPACT] Please describe your proposed solution.

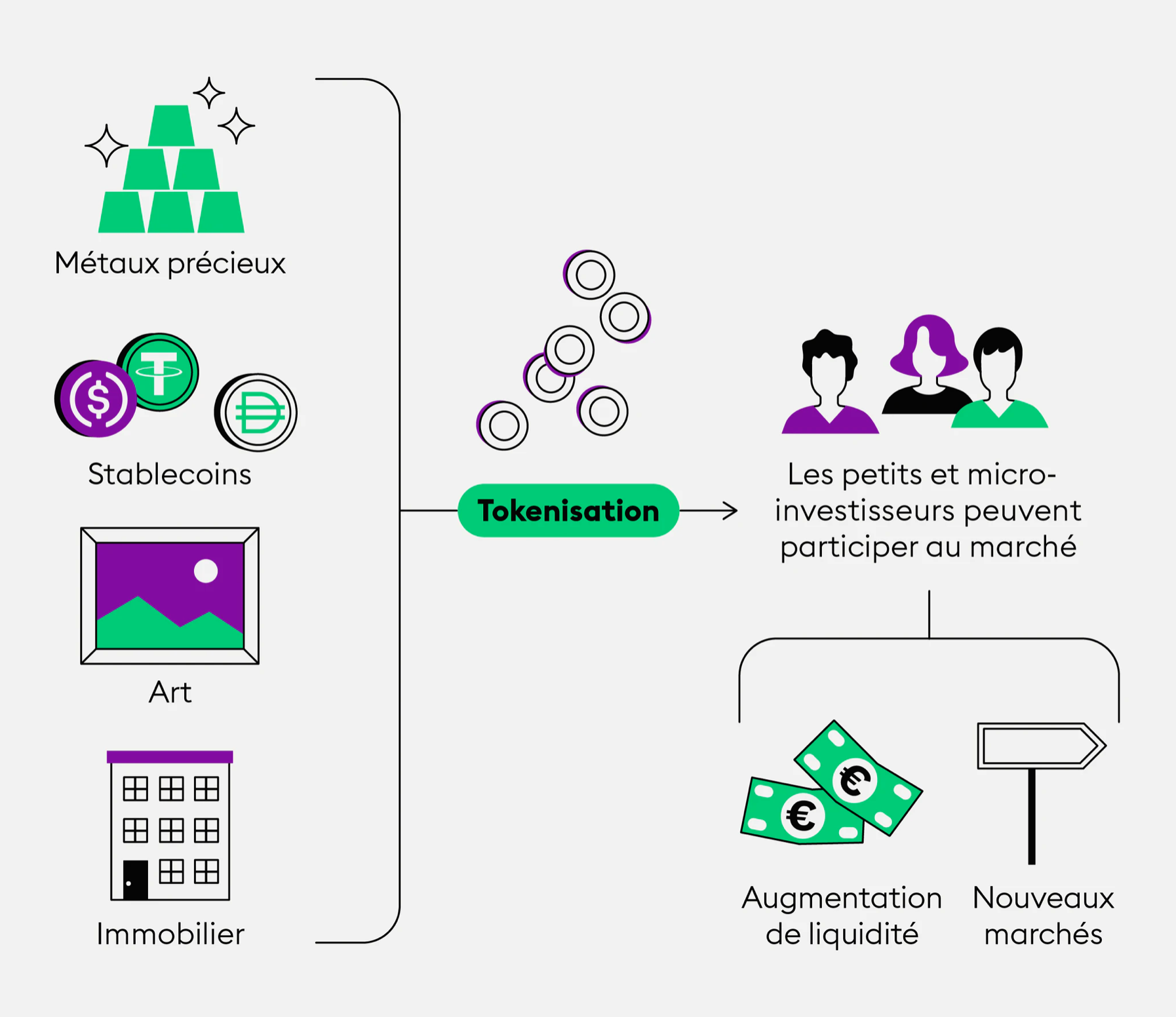

Real estate tokenization or tokenization of a real estate asset can be defined as the process of registering a real estate asset (such as a real estate property or a share in a company) and the rights attached to this asset (voting rights, right to receive dividends, etc.) on a digital token registered on a blockchain. These cumbersome circumstances lead to increased costs and time expenditures. However, if real estate is tokenized, time-consuming and inefficient processes through intermediaries become obsolete, as blockchain is based on the peer-to-peer principle. Blockchain technology therefore creates trust between two contractual partners and guarantees a secure process thanks to its technical basis. It also increases transparency and automation and enables the international transfer of tokens (real estate shares) in seconds.

The real estate industry itself is not agile and the buying and selling processes are very complex. In addition, unpredictable events such as construction errors and natural disasters can have a negative impact on liquidity.

Design efficient and cost-effective process solutions. This significantly increases liquidity and mitigates the negative impact. Therefore, a huge boost to liquidity is generated by the ability to fragment real estate investments through tokenization, i.e., effectively offering smaller shares at the desired price and the associated "partial tokenization."

This allows for the efficient use of intangible property assets through the sale of certain shares, which will certainly transform the sales process from static to dynamic. And it will offer owners much more flexibility.

Tokenization gives institutional and retail investors the opportunity to diversify their portfolios.

Let's take an example of how tokenization can be applied: Normally, you either pay rent or buy real estate. With tokenization, a combination of these two options is possible. You could own 60% of the property and acquire 40% by tokenization. This 40% can be offered on a secondary market and can work like a mortgage. You will not need a financial service provider or bank to do this. Therefore, the necessary capital can be obtained at any time from assets you already own that are not yet fungible.

[IMPACT] Please describe how your proposed solution will address the Challenge that you have submitted it in.

Concerning the investor

As regards traditional real estate investment, several solutions are offered to him:

The purchase of a property;

The purchase of shares in SCI (Société Civile Immobilière) or SCPI (Société Civile de Placement Immobilier);

The purchase of shares in real estate investment funds or commercial companies (notably SAS immobilières).

In terms of investment through the tokenization of real estate, the investor will acquire a token that could represent :

A property, its ownership and the rights attached to it;

A set of real estate properties, their ownership and the rights attached to them;

The share of a real estate, its ownership and the rights attached to it;

The shares of an SCI, SCPI, a real estate investment fund or a commercial company.

Good to know: it is possible to back the tokenization of a real estate asset with a smart contract to allow investors to be automatically paid rental income when the property is rented.

The advantages of the tokenization of the real estate for the issuer of the token

The following benefits can be noted:

Using the blockchain to divide a real estate asset or ownership into a multitude of tokens;

Possibility to diversify the markets by offering real estate assets all over the world without geographical barrier;

Increase the liquidity of a real estate asset by exchanging tokens on a new market open 7/7 and 24/24;

Possibility to use smart contracts to automate the contractual conditions of the token sale.

Benefits of real estate tokenization for the investor

It is possible to identify the following advantages:

Use the blockchain to acquire a property right on a real estate or a share of it;

Enable the rapid acquisition and sale of real estate tokens in a secure and decentralized manner through the blockchain;

Access the real estate market without a barrier to entry;

Obtain a low transaction cost for the purchase and sale of real estate tokens (as the law currently stands, there are no registration fees to be paid following the sale of real estate tokens on a blockchain). Translated with www.DeepL.com/Translator (free version)

[IMPACT] What are the main risks that could prevent you from delivering the project successfully and please explain how you will mitigate each risk?

Above all, tokenized assets are considered even more nascent than cryptocurrencies. While there are many benefits, new internationally aligned regulatory frameworks, including the definition of custody and supervision, are essential to democratize investments and make asset tokenization commonplace.

Currently, a portion of the players in traditional financial systems consider asset tokenization to be contrary to their interests, making them indifferent to the new opportunities offered by decentralized and democratized investments. Other concerns about asset tokenization are the apprehension of stability issues in the case of highly liquid markets, security and risk issues, trust issues and network scalability. It also highlights the need for public investment in financial education to reach new groups of investors.

In any case, the tokenization of assets is set to fundamentally change the power dynamics within financial markets in the coming decades, lowering monetary barriers for small investors, opening up new markets and opportunities, and broadening investor bases with the real potential to break down barriers to investment.

[FEASIBILITY] Please provide a detailed plan, including timeline and key milestones for delivering your proposal.

September - November 01: Design a website to map real estate in the city of Goma that is easily accessible by teams and identify real estate.

September - December 22: Create issue certificates that investors in real estate will use to sign for real estate. The claims are the real tokens that each investor and the real estate will possess, certifying the information on the real estate (possible details).

December - January 05: Gives the possibility to the general public to generate the tokenisers the real estate.

From March 05: Publish all the Tokens by linking them to the quantities of real estate in the DRC.

March 05: Offer validation tools on the website to certify the validity and generate token based on its identification format.

[FEASIBILITY] Please provide a detailed budget breakdown.

The production of the decentralized application to produce the tokens for each property will include the following.

Design Validation of the website $10000

Portfolio connection functionality

Mapping functionality

Validation functionality

Real estate catalog $60000

Road trips for three validators

Educate property owners

Onboard investors: $20000

Identify Cardano wallets that support DIDs.

Educate real estate investors on the benefits of using blockchain for real estate tokenization.

Support the acquisition of wallets by the through the onboarding process or the registry on the platform.

Tools and Equipment:

10 Tablets for real estate registration: $5000

[FEASIBILITY] Please provide details of the people who will work on the project.

KAVIRA MUSEKWA Lydie : currently first term assistant teacher and responsible for the computer lab at ISIG-GOMA, (https://www.isig.ac.cd/), holder of a bachelor's degree in computer network and telecommunications from ISIG-GOMA; has experience in developing front-end websites. (https://github.com/Ld03-muss/)

Akilimali Cizungu Innocent: Proposal lead, hi is the technical analyst within ISDR/GL (www.isdrgl.org) and holds a degree in computer science from ISIG (https://www.isig.ac.cd/). Akilimali is also the technician supporting the Cardano Stake Pool. Akilimali has experience in front-end and back-end developments.

https://www.linkedin.com/mwlite/in/akili-innocent-7649951a8

https://github.com/Innocent-Akim

Nturubika Moïse: Mobile and backend Developer with a degree in computer science at ISIG GOMA(www.isig.ac.cd). IT Assistant at OKONECT DRC(www.okonect-drc.com).

https://github.com/Moise-Nturubika

https://www.linkedin.com/in/moise-nturubika

https://twitter.com/MoiseNturubika

[FEASIBILITY] If you are funded, will you return to Catalyst in a later round for further funding? Please explain why / why not.

No

Because real estate tokenization projects in the future only need to be started and the systems will be able to finance themselves for the further development

[AUDITABILITY] Please describe what you will measure to track your project's progress, and how will you measure these?

How tokenization could democratize investing

As the world transitions to digitization, the process of securitizing ownership of assets is also changing. Instead of a "physical" document, a digital token digitally represents certain conditions under certain circumstances.

[AUDITABILITY] What does success for this project look like?

The success of this project will consist of:

Introducing a Cardano-based Certified Trading Chain (CTC) certification system for the tokenization of real estate in the DRC.

Mapping of real estate in each city and certified city.

Develop and pilot technical methods to improve control.

Onboarding investors and small scale through the DApp.

Generate fees through validation and resale of DIDs.

[AUDITABILITY] Please provide information on whether this proposal is a continuation of a previously funded project in Catalyst or an entirely new one.

New propos

Sustainable Development Goals (SDG) Rating

Represents anything that is considered to have monetary value to at least two parties and has the ability to be exchanged with another asset of the same type, meaning that it is "fungible. An asset can be a good, a physical object or even a right.