[IMPACT] Please describe your proposed solution.

Problem Statement expansion:

Due to how certain stake pool fees work, delegating to stake pools with low active stake penalizes delegators by reducing their net (after fees) staking rewards compared to stake pools with more active stake, as can be seen in the following graph.

This issue harms new SPOs by making it hard to get new delegations as they are not able to provide competitive returns compared to other more established stake pools.

Thus reducing the current rate of appearance of new stake pools, lowering the emphasis on mission-driven pools & single-stake pool operators, and making profitability the main driver for a user to pick a specific stake pool.

The problem presented, if not taken care of, may end up centralizing the allocation of active stake toward stake pool farms like the ones in the following graph.

Theorized solution:

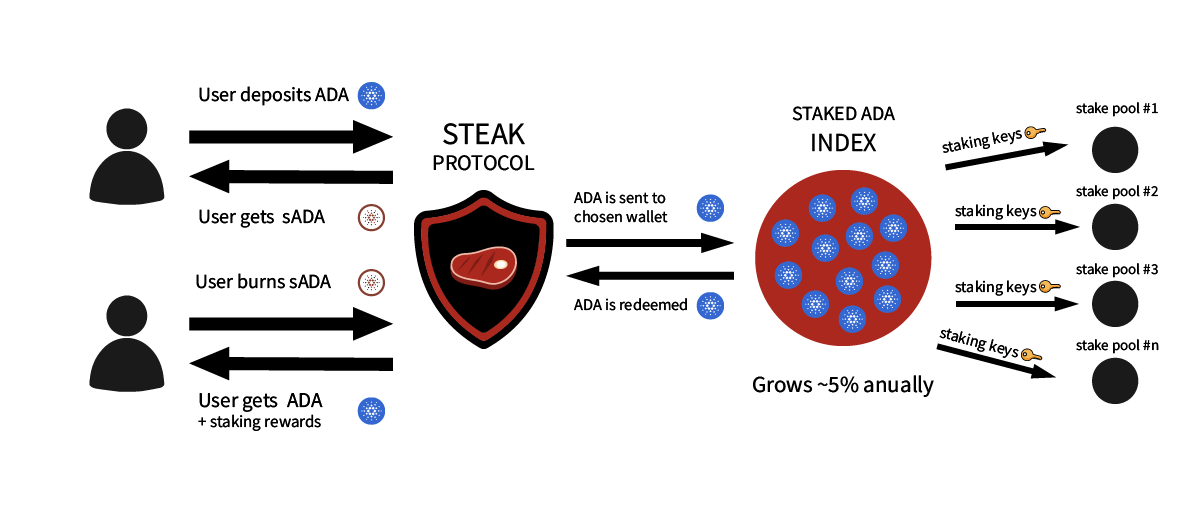

The unique approach proposed involves allowing users to swap their ADA for a token called sADA, which represents staked ADA inside the protocol.

The staking rewards of the users of the protocols will then be the average of all the stake pools on the protocol.

To ensure all stake pools are providing the same rewards as the fixed average, the SPOs are to sign a smart contract that subtracts from or adds to their stake pool fees depending on various factors.

In theory, this approach would not only help small SPOs, and allow users to get consistent and competitive staking rewards, but it would also allow for universal double yields.

[IMPACT] Please describe how your proposed solution will address the Challenge that you have submitted it in.

The proposed solution is going to address the challenge by investigating the viability of a DeFi protocol.

By ensuring that there is a real use case and the approach proposed is technically possible, the core philosophy of Cardano, based on peer review and vigorous examination is being implemented.

In the case that, this solution goes through the research phase, it has the potential to make Cardano a more vibrant ecosystem by making it more convenient for users and fostering the creation of new stake pools with more emphasis on providing to the community.

[IMPACT] What are the main risks that could prevent you from delivering the project successfully and please explain how you will mitigate each risk?

For the following proposal, the current objective is to investigate the feasibility of the project itself, analyze the problem in-depth, and publish papers on both.

So, even if the approach to solve the issue is unfeasible, the publications on the problem are to be made regardless, thus providing value to the community even in the worst-case scenario.

As for the approach itself, the main risks that it may encounter are:

-

It may be technically impossible to execute: hence the emphasis on research and peer review beforehand. To mitigate the damage that could be done if this step were to be skipped.

-

The problem it's solving doesn't exist or the solution is worse: to reiterate what was mentioned above. The parts involved are going to be interviewed during the research phase to ensure the problem the approach mentioned solves a real problem.

[FEASIBILITY] Please provide a detailed plan, including timeline and key milestones for delivering your proposal.

The implementation of the solution is to be split into 3 phases:

- Research.

- Team building and fundraising.

- development and growth.

For this proposal, phase one, "Research", is going to be the main focus due to the next two being dependent on the results of the former.*

Phase 1: Research

In this phase, the feasibility of the solution is two be determined. To do so, both the solution and the problem area to be thoroughly analyzed. So heavy research is to be made about how fees, profitability, and pool size correlate, and what their effects are on stake pools.

Both SPOs and developers are going to be consulted about the nature of the problem and the feasibility of the solution.

After consulting, the information gathered about the problem is going to be compiled into an academic paper, and, if the approach is technically possible, a whitepaper for Steak Protocol V1 is going to be written.

Week 1:

- Research about the relationship between Cardano's different mechanisms and the amount of active stake on a stake pool. Comparing the profitability of both, and compiling all the information on a paper about this issue.

Week 2-3:

- Arrange meetings with SPOs from the single-stake pool operator alliance to get feedback on the information compiled in the paper aforementioned.

Week 4:

-

Revise and finalize the paper on the problem, and the effects it has on the ecosystem. Taking into account and adding any information and revisions SPOs may have contributed to the paper.

-

Publish this iteration of the paper.

Week 5:

- Begin to iterate on the first official whitepaper of "Steak Protocol" with the information acquired at the time of writing the paper on the problem.

Week 6-7:

-

Reach out to developers for auditing the initial version of the white paper to ensure that the approach proposed is technically possible.

-

Reach out to SPOs again to ensure the solution is attractive enough, and gain additional feedback.

Week 8: (if feedback is positive)

-

Finalize the V1 white paper for Steak Protocol taking into account the feedback given by the developers and any other contribution any one of the former may have contributed to the whitepaper.

-

Publish the whitepaper.

Long-term plan:

If after the completion of the 1st phase, the feasibility of the solution is proven. The following two phases are going to roll out.

Phase 2: Team building and Fundraising

In this phase, the members of the core team are going to be established, and a startup is going to be created legally. After this step is done, private funds for developing the solution are going to start to be accepted.

Further investigation of the approach is going to be discussed and consulted with SPOs and community members.

Phase 3: Development and growth:

If enough capital for developing the platform was raised, the development of the protocol is going to begin. This phase may roll out in parallel with phase 2 after the team is built.

*During all 3 phases, the project's team is expected to constantly grow.

[FEASIBILITY] Please provide a detailed budget breakdown.

$20 per hour · 8hs a day · 5 days a week · 8 weeks · 1 lead researcher = $6400

[FEASIBILITY] Please provide details of the people who will work on the project.

Elias Aires: After his first steps in trading, he decided to learn more about Blockchain technology. Created a Cardano brand, CardanoWeekly on Instagram. Doing SPO marketing he discovered how overwhelming the support of the Cardano community is and how the project and its ecosystem work via simplifying information for a more general audience. He then joined Token Allies, a RealFi startup in Cardano where he transitioned his skills to a more institutional landscape. Currently studying systems engineering and working as a team member at Token Allies.

LinkedIn: https://www.linkedin.com/in/elias-aires-342058236/

Twitter: https://twitter.com/CardanoWeekly

Instagram: https://www.instagram.com/cardanoweekly/

[FEASIBILITY] If you are funded, will you return to Catalyst in a later round for further funding? Please explain why / why not.

If the viability of the solution proposed is proven after the date provided, a proposal for the development of the solution is going to be made in order to develop an MVP of the protocol.

[AUDITABILITY] Please describe what you will measure to track your project's progress, and how will you measure these?

To ensure the auditability of the proposal, concrete goals with proof of completion are going to be provided:

-

Number of SPOs consulted: not less than 5. Proof of the consultation is to be provided to audit the completion of this step.

-

Number of Developers consulted: not less than 5, at least 3 of them have to know Plutus. Proof of the consultation is also to be provided to audit this step.

-

Elaboration of the problem statement paper: From the beginning, this paper is going to be on docs, and public, meaning that anyone interested is going to be able to audit the completion of it. After it's done it is going to be published elsewhere, but the docs will remain open.

-

Elaboration of the solution's white paper: This one is not going to be public, but whoever is in charge of auditing the completion of it is going to have access to the private docs on which it is being written. And it is going to be published once finished.

-

Peer review: To ensure the quality and veracity of both the white paper and the problem statement paper, after the publication, anyone interested is going to be able to provide feedback &/or audit them.

[AUDITABILITY] What does success for this project look like?

-

consulting 5 SPOs.

-

consulting 5 developers.

-

Produce a high-quality paper on the problem.

-

Prove the viability or unviability of the solution.

-

If the solution is viable, produce a high-quality whitepaper on the solution.

[AUDITABILITY] Please provide information on whether this proposal is a continuation of a previously funded project in Catalyst or an entirely new one.

No, this proposal is entirely new.